Do Payday Loans Affect Your Credit Rating?

Payday loans can sometimes be unavoidable. An unforeseen cost can leave you caught short and in need of a small amount of cash to cover the bill before payday. Lenders will check your credit rating before approving an application, but do payday loans affect your credit rating themselves? Clear And Fair have the answers to help you better understand payday loans and the impact they have upon your credit score.

Want to see how different payday loans compare? Use our loan comparison tool!

Credit Ratings Explained

Credit scores are used as a measure of reliability. When a lender is going to provide a loan, they want to know that they can rely on you to pay it back. This includes any kind of loan, from payday loans through to mortgages.

A credit score will therefore be created based on money you’ve borrowed in the past and when you paid it back. At its simplest, if you have borrowed money and paid if back on time, then you’ll have a good credit score. If you’ve borrowed money and failed to pay it back or were delayed, then your credit score will decrease.

However, while that’s the basic idea, credit scores aren’t actually that simple in practise. There are a lot of other factors that influence your credit score to different degrees, such as the amount of credit you use and the length of time your credit history spans.

If you have a credit card and frequently get close to your credit limit, then it can negatively impact your score. On the other hand, a lot of CRAs determine that if you borrow less than 30% of your limit and pay it back on time, then you’re more likely to have a good credit score. (According to Experian, one of the UK’s three most widely used CRAs). This helps a lender to know that you’re not usually highly dependant upon loans and that you’re likely to pay money back.

Similarly, your credit rating will be higher if you have a longer credit history. If your credit history only spans a month, lenders aren’t going to know whether or not you’re actually reliable in the long run.

It’s also worth noting that there are a number of different credit reference agencies (CRAs) in the UK. This means that you don’t have a single definitive credit score, but it will vary slightly according to each CRA.

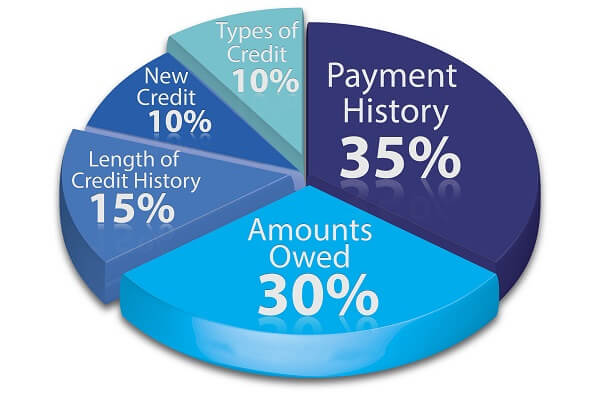

This chart above shows an example of the factors that may go into determining your credit score. Because there are different Credit Reference Agencies, this functions as an illustration to give you an example of the sorts of things that may be considered. The exact factors and weighting that go into your individual credit score will be determined by the Credit Reference Agency with whom you are checking your score.

Credit & Loans

There are two forms of credit that impact your credit score: instalment credit and revolving credit.

Revolving credit is mostly associated with credit cards. This means that you have a borrowing limit and, as long as you make the minimum monthly repayments, there’s no fixed due date for repayment.

There are also revolving credit alternatives to credit cards, such as Polar Credit which is our sister brand and is also operated by our company, APFin. You can visit www.polarcredit.co.uk to find out more about them.

Instalment credit means that you borrow a fixed amount and repay at fixed times, such as monthly or by a certain date. This includes a lot of different types of loans including student loans, mortgages and short term loans, like payday loans.

Both of these varieties impact your credit score, including payday loans.

Payday Loans & Your Credit Rating

A payday loan is a type of short term loan. They’re used in emergency situations where an unforeseen cost means you need quick cash to cover the expense until payday. They’re usually paid back within 31 days.

As mentioned, it’s a variety of instalment credit (not to be confused with an instalment loan, which is a specific variety of short term loan), which means that it does impact your credit rating. This can be positive or negative depending on the way you handle the loan.

Improving Credit Rating

A payday loan could improve your credit rating. If you apply for the loan, are accepted and pay it back within the time agreed with your lender, then it can be beneficial to your credit score.

Remember that the purpose of a credit rating is to access how reliable you are for future loans and repaying money. If you repay your loan on time, then you have proven that you can reliably pay back a loan and your credit score will reflect that.

Decreasing Credit Rating

However, just like any other loan, a payday loan could decrease your credit score if you don’t pay it back on time. Late repayments, or rescheduling your repayment date, suggests that you are more unreliable and therefore your credit rating will reflect that.

It’s also important to remember that late repayments could lead to serious debt. If you know before applying that you won’t be able to pay your loan back, then you should always look at other options and seek financial advice instead. The more debt you get into, the greater the negative impact upon your credit score.

Mortgage Approval

While a payday loan can improve your credit score, it’s important to note that they might impact loan approval for other loans in a different way. On your credit report, potential lenders will be able to see the types of loans for which you’ve applied previously. This could impact your ability to get a mortgage in the near future.

Mortgage providers, such as banks, can see that you’ve applied for a payday loan recently and therefore conclude that you have been struggling financially. Because mortgages are such large loans, banks might not approve a mortgage application to anyone they think is at risk of financial difficulty.

However, this only applies if you’ve applied for a payday loan recently. For example, if you applied for a payday loan five years ago, the bank will know that it no longer represents your current financial position.

Does applying for a payday loan impact credit score?

Applying for a payday loan or short term loan can impact your credit score because it shows up on your credit report.

When you apply for a payday or short term loan, the lender will complete what’s called a ‘hard search’ of your credit report. Whenever a hard search is completed of your credit file, it gets recorded. Other lenders in the future can see that you’ve applied for a loan and, if you’ve got a large number in a short space of time, it might suggest that you’re frequently in an unstable financial position and therefore not likely to be a reliable borrower.

If you apply for several loans, every instance will be recorded separately. This means you should try to only ever apply for the loan which you think is most likely to be accepted, rather than trying several applications. This will have the smallest impact upon your credit score.

The biggest way that applications on your credit file will affect you is if you want to apply for a mortgage in the near future. As mentioned, mortgage providers will usually take this to mean that you’re not in a financially stable position so will not want to provide you with such a large and long-term loan.

You should do what you can to only apply for loans that you need and for which you’re likely to be accepted. Always read the lender’s criteria before making an application to check whether you’re likely to be successful. There are sometimes options to run a ‘soft search’.

Soft Searches

While hard searches, such as those run when applying for a short term loan, appear on your credit file, there are instances where you or a lender can run a soft search. This is a less thorough search that gives an idea of whether you’re likely to be approved for a loan.

Lenders or loan comparison sites sometimes offer soft searches before you apply for a loan so you can understand whether you’re likely to be approved and whether it’s worth making an application that will then be on your record.

Do Payday Loans Affect Your Credit Rating?

Payday loans do affect your credit rating. This can be positive or negative depending on how you handle the loan, but they do appear on your credit file and potential future lenders can see loan applications.

You should only apply for payday loans that you need and know you can repay.

All you need to know about short term loans

The best saving tips, budget ideas and ways to improve your financial health